Trusted by100+Partners & Customers

In today's fast-paced business environment, managing payroll efficiently is a top priority for organizations of all sizes. From calculating wages and deductions to ensuring compliance with tax regulations, payroll can be a complex and time-consuming task. This is where payroll software steps in as a game-changer, revolutionizing the way businesses handle their payroll processes.

There are several effective payroll software options available in Nigeria that can help streamline and automate payroll processes for businesses. Here are five popular ones:

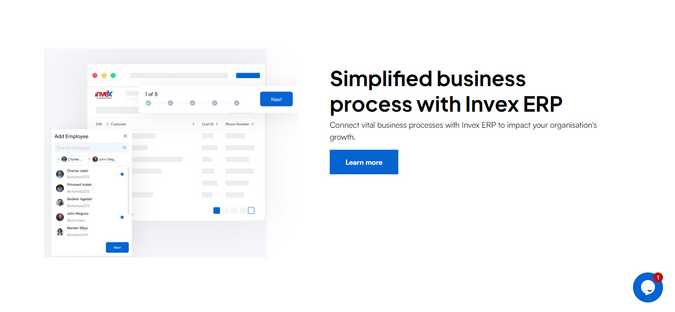

1 | InvexERP Payroll:

InvexERP Payroll is a widely used enterprise resource planning (ERP) software that offers a payroll module specifically designed for Nigerian businesses. It helps you prepare and process payroll, generate payslips, annual reports, accounting, payment management, time and activity tracking.

It helps you plan your employee budget, company segmentation, and manage time and activities. With it, you can effectively monitor employee attendance and manage their sick and annual leave, and plan for staff emergencies. You can also manage work hours, shifts and cycles, as well as bonus allocation and leave entitlement.

InvexERP Payroll is a widely used enterprise resource planning (ERP) software that offers a payroll module specifically designed for Nigerian businesses. It helps you prepare and process payroll, generate payslips, annual reports, accounting, payment management, time and activity tracking.

It helps you plan your employee budget, company segmentation, and manage time and activities. With it, you can effectively monitor employee attendance and manage their sick and annual leave, and plan for staff emergencies. You can also manage work hours, shifts and cycles, as well as bonus allocation and leave entitlement.

InvexERP HR and payroll software helps you map and track employees’ skills and competencies, and map and define their job roles, including skills requirements. This information can then be used to determine their performance management requirements – skills assessments, training programmes and internal skills transfer plans.

With InvexERP cloud-based payroll software you can generate payroll in the right format to upload to any third-party payment platform, like your bank salary payment platforms.

Benefits of InvexERP Payroll:

- Streamlined Payroll Management: InvexERP Payroll simplifies and automates the entire payroll management process, making it easier for businesses to calculate and process employee salaries, taxes, and deductions. This saves time and reduces the potential for errors in manual calculations.

- Accurate Tax Calculations: InvexERP Payroll incorporates up-to-date tax regulations and automatically calculates taxes based on the applicable rates. It helps ensure accurate tax deductions, reducing the risk of non-compliance and avoiding penalties or legal issues.

- Secure and Confidential Data: InvexERP Payroll prioritizes data security and employs robust encryption and security measures to protect sensitive payroll information. It provides a secure platform for storing and managing employee data, ensuring confidentiality and compliance with data protection regulations.

- Time and Cost Savings: By automating payroll processes, InvexERP Payroll significantly reduces the time and effort required for manual payroll management. This frees up HR personnel to focus on other strategic activities and saves costs associated with manual processing, such as printing and distributing paper pay checks.

- Reporting and Analytics: InvexERP Payroll offers comprehensive reporting and analytics features, allowing businesses to generate customized reports on various payroll metrics. These insights provide valuable information for financial analysis, budgeting, and decision-making.

- Integration with Accounting Systems: InvexERP Payroll seamlessly integrates with accounting software, enabling smooth synchronization of payroll data with financial records. This integration ensures accurate financial reporting and eliminates the need for manual data entry, reducing errors and saving time.

- Compliance with Regulatory Changes: InvexERP Payroll stays up to date with changes in tax laws, labour regulations, and other statutory requirements. It helps businesses stay compliant with these changes by automatically updating tax rates and incorporating new regulations into the payroll system.

- Scalability: InvexERP Payroll is designed to accommodate the needs of businesses of various sizes, from small startups to large enterprises. It can scale with the growth of the organization, accommodating an increasing number of employees and adapting to evolving payroll requirements.

All five payroll packages are good for small,medium, and large-sized companies. They offer almost the same features.

InvexERP Payroll is a simple, affordable, fast and easy-to-use software that has been used and trusted for almost a decade by reputable companies like Thermocool Distribution, PKO Technologies Ltd. (Port Harcourt), Pep Philips Ltd. (Lagos), Tiwanet Technologies Ltd (Lagos), Samsung Homes (Port Harcourt), PertroBase Group, Amarava Agroprocessors Ltd. (India), Foru-Solution B.V Ltd. (Lagos), Solak Expertise Ltd. (Lagos), Moreplex Television Ltd. (Lagos), Isocare Ltd. (Lagos), Bozz FM (Aba), House On The Rock (Port Harcourt), Olikks Electriks (Port Harcourt), Atlantic Marine & Oilfield Services (Lagos), Hydroferric Marine Ltd. (Port Harcourt), Fexspace Ltd. (UK), Tropical Naturals Plc (Lagos), Oil Train Ltd. (Port Harcourt), Deslog Energy Services Ltd. (Port Harcourt), and many others in different locations of the country.

2 | QuickBooks Payroll:

QuickBooks is a widely used accounting software that also offers a payroll module specifically designed for Nigerian businesses. It provides features such as automated salary calculations, tax calculations, payslip generation, and direct bank integration.

Overall, QuickBooks Payroll simplifies the payroll process, minimizes errors, and saves time for businesses. It offers a user-friendly interface and robust features to handle payroll tasks effectively, empowering businesses to focus on core operations while ensuring compliance and accurate payroll management.

3 | PayDayNG:

PayDayNG is a Nigerian payroll software solution that offers comprehensive payroll management features. It can handle various payroll components such as salary calculations, statutory deductions, tax calculations, leave management, and employee self-service.

Overall, PayDayNG simplifies payroll management, improves accuracy, ensures compliance, and provides valuable time and cost savings for businesses in Nigeria. By leveraging its features and functionalities, organizations can streamline their payroll processes and focus on strategic initiatives, ultimately enhancing efficiency and productivity.

4 | Sage HR and Payroll:

Sage is a globally recognized provider of business software, including HR and payroll solutions. Sage HR and Payroll offer a range of features such as automated payroll processing, compliance with Nigerian tax regulations, leave management, and report generation.

Overall, Sage HR and Payroll streamlines HR processes, ensures accurate payroll management, enhances compliance, and provides valuable time and cost savings for businesses. It empowers organizations to efficiently manage their workforce while maintaining legal compliance and delivering accurate and timely payroll processing.

5 | HRMSoft:

HRMSoft is a Nigerian payroll and human resource management software that provides end-to-end HR and payroll solutions. It includes features like employee data management, attendance tracking, salary calculations, tax compliance, and employee self-service.

Here are some key advantages of using HRMSoft:- Centralized Employee Data: HRMSoft allows businesses to store and manage all employee-related information in a centralized database. This enables easy access to employee records, including personal details, contact information, employment history, training records, performance evaluations, and more. Having a centralized system improves data accuracy and eliminates the need for manual record-keeping.

- Streamlined Recruitment and Onboarding: HRMSoft simplifies the recruitment and onboarding process by automating tasks such as job posting, resume screening, applicant tracking, interview scheduling, and document management. It enables HR professionals to efficiently manage candidate information, track the hiring process, and smoothly onboard new employees, saving time and ensuring a positive candidate experience.

- Efficient Leave and Attendance Management

6 | Zoho Payroll:

Zoho Payroll is a cloud-based payroll software that can be customized to meet the specific needs of Nigerian businesses. It offers features such as payroll processing, tax calculations, leave management, and employee self-service.

Before selecting a payroll software, consider factors such as the size of your business, specific payroll requirements, ease of use, cost, customer support, and integration capabilities with other systems you use. It's advisable to request demos or trial versions of the software to evaluate their suitability for your business before making a decision.

Whether you are a small business owner or an HR professional, an efficient payroll software can streamline your payroll operations and drive greater efficiency.